Portugal Sales Tax . The standard vat rate generally applies for all goods. The standard vat rate is 23%. Web the current rates are: Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. The standard vat rate is 23%. Web vat rates by goods and services in portugal. Web in portugal, the sales tax rate is a tax charged to consumers based on the purchase price of certain goods and services. Web vat rates by goods and services in portugal. Vat is paid by consumers when paying for. Web supplies of goods are subject to vat in portugal if the goods are in portugal when their transport or dispatch to the. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. € 0 for digital goods. The standard vat rate generally applies for all goods. The benchmark we use for the.

from taxfoundation.org

Web vat rates by goods and services in portugal. The standard vat rate is 23%. Web vat rates by goods and services in portugal. The standard vat rate generally applies for all goods. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. The standard vat rate is 23%. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. Web supplies of goods are subject to vat in portugal if the goods are in portugal when their transport or dispatch to the. Web the current rates are: The standard vat rate generally applies for all goods.

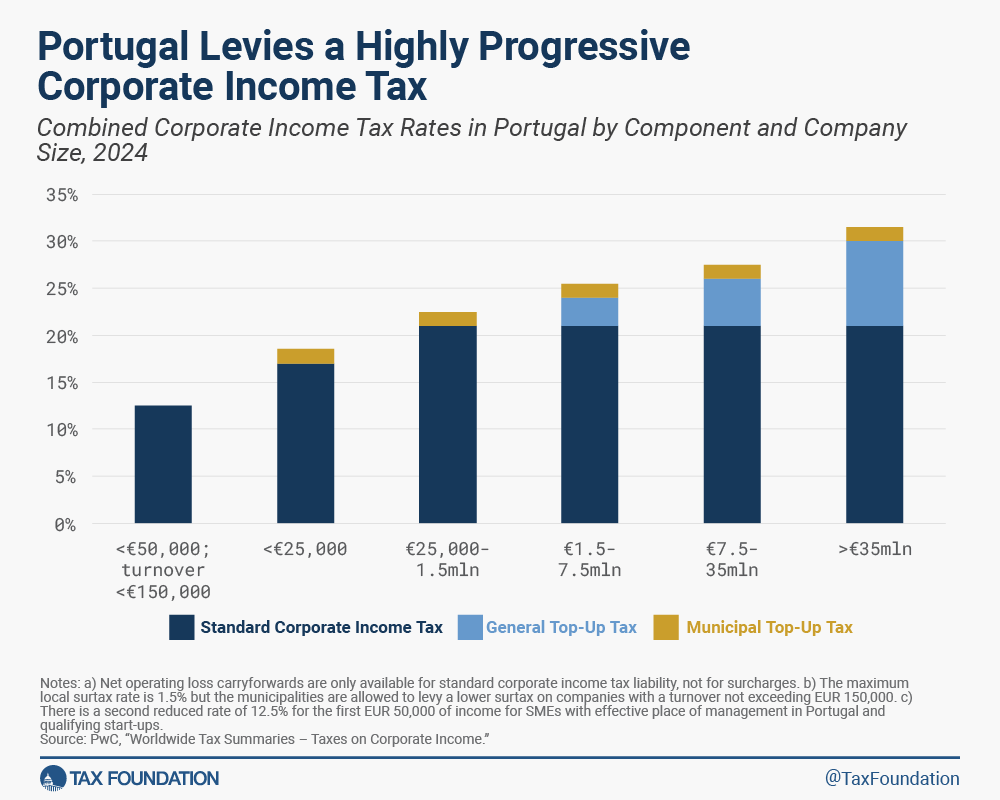

Portugal Corporate Taxes Stifle Investment and Economic Growth

Portugal Sales Tax The standard vat rate is 23%. Web vat rates by goods and services in portugal. The standard vat rate is 23%. The standard vat rate generally applies for all goods. Web supplies of goods are subject to vat in portugal if the goods are in portugal when their transport or dispatch to the. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. The benchmark we use for the. Vat is paid by consumers when paying for. Web in portugal, the sales tax rate is a tax charged to consumers based on the purchase price of certain goods and services. Web the current rates are: Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. Web vat rates by goods and services in portugal. The standard vat rate is 23%. € 0 for digital goods. The standard vat rate generally applies for all goods.

From www.asrolhas.com

Tax in Portugal As Rolhas Portugal Sales Tax The standard vat rate is 23%. € 0 for digital goods. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. Web the current rates are: Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. The benchmark we use. Portugal Sales Tax.

From www.cryptonewsz.com

Portugal Tax Authority Removes Taxation on Crypto Trading and Payments Portugal Sales Tax The benchmark we use for the. Web the current rates are: Web vat rates by goods and services in portugal. € 0 for digital goods. Vat is paid by consumers when paying for. The standard vat rate is 23%. Web in portugal, the sales tax rate is a tax charged to consumers based on the purchase price of certain goods. Portugal Sales Tax.

From www.youtube.com

PORTUGAL Tax Rate For Foreigners Tax Guide YouTube Portugal Sales Tax Web the current rates are: Web supplies of goods are subject to vat in portugal if the goods are in portugal when their transport or dispatch to the. The standard vat rate is 23%. Vat is paid by consumers when paying for. The standard vat rate is 23%. Web vat rates by goods and services in portugal. The benchmark we. Portugal Sales Tax.

From www.youtube.com

Taxes in Portugal (Tax System in Portugal) YouTube Portugal Sales Tax Web in portugal, the sales tax rate is a tax charged to consumers based on the purchase price of certain goods and services. Web the current rates are: The standard vat rate generally applies for all goods. The standard vat rate generally applies for all goods. Web vat rates by goods and services in portugal. Web supplies of goods are. Portugal Sales Tax.

From www.portugal.com

Guide to Taxes The Tax System in Portugal Portugal Sales Tax The standard vat rate is 23%. Web vat rates by goods and services in portugal. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. The standard vat rate generally applies for all goods. The standard vat rate generally applies for all goods. € 0 for digital. Portugal Sales Tax.

From viveurope.com

How To Pay Corporate Tax In Portugal Viv Europe Portugal Sales Tax € 0 for digital goods. Web vat rates by goods and services in portugal. The standard vat rate is 23%. The standard vat rate is 23%. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. The benchmark we use for the. Web the current rates are: Web businesses in portugal are required. Portugal Sales Tax.

From www.globalcitizensolutions.com

Taxes in Portugal For Expats The Complete Guide Portugal Sales Tax Web vat rates by goods and services in portugal. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. Web vat rates by goods and services in portugal. The standard vat rate is 23%. Web the current rates are: Vat is paid by consumers when paying for. The standard vat rate generally applies. Portugal Sales Tax.

From www.icalculator.info

Portugal Tax Rates and Thresholds in 2023 Portugal Sales Tax Web vat rates by goods and services in portugal. Web in portugal, the sales tax rate is a tax charged to consumers based on the purchase price of certain goods and services. The standard vat rate generally applies for all goods. € 0 for digital goods. Web vat rates by goods and services in portugal. The benchmark we use for. Portugal Sales Tax.

From www.globalcitizensolutions.com

The Tax System in Portugal A Guide for Expats Portugal Sales Tax Web supplies of goods are subject to vat in portugal if the goods are in portugal when their transport or dispatch to the. € 0 for digital goods. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf. Portugal Sales Tax.

From www.reddit.com

Total revenue from taxes and social contributions in the EU Member Portugal Sales Tax € 0 for digital goods. The standard vat rate is 23%. Vat is paid by consumers when paying for. Web in portugal, the sales tax rate is a tax charged to consumers based on the purchase price of certain goods and services. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. Web. Portugal Sales Tax.

From taxfoundation.org

Portugal Corporate Taxes Stifle Investment and Economic Growth Portugal Sales Tax Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. Web vat rates by goods and services in portugal. Web in portugal, the sales tax rate is a tax charged to consumers based on the purchase price of certain goods and services. Web value added tax (vat). Portugal Sales Tax.

From www.moneyinternational.com

Expat Guide To Paying Tax In Portugal • Money International Portugal Sales Tax Web supplies of goods are subject to vat in portugal if the goods are in portugal when their transport or dispatch to the. Web vat rates by goods and services in portugal. The standard vat rate generally applies for all goods. Web the current rates are: Web value added tax (vat) is a tax levied on sales or supplies of. Portugal Sales Tax.

From www.mondaq.com

International Double Taxation In Portugal Update Tax Authorities Portugal Sales Tax The standard vat rate generally applies for all goods. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. € 0 for digital goods. The standard vat rate is 23%. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal.. Portugal Sales Tax.

From taxfoundation.org

Portugal Corporate Taxes Stifle Investment and Economic Growth Portugal Sales Tax The standard vat rate generally applies for all goods. The standard vat rate is 23%. Web supplies of goods are subject to vat in portugal if the goods are in portugal when their transport or dispatch to the. € 0 for digital goods. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal.. Portugal Sales Tax.

From www.ourlifeinportugal.com

Sales Taxes & Why They matter Our Life in Portugal Portugal Sales Tax Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. Web the current rates are: The standard vat rate is 23%. The standard vat rate is 23%. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. € 0 for. Portugal Sales Tax.

From essencial-portugal.com

Taxes in Portugal the country wants to be transparent Portugal Sales Tax The standard vat rate is 23%. € 0 for digital goods. Web the current rates are: Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. The standard vat rate is 23%. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must. Portugal Sales Tax.

From portugalsolved.com

Tax Brackets in Portugal Explained [November 2023 Update] Portugal Sales Tax € 0 for digital goods. The standard vat rate is 23%. Web the current rates are: Web vat rates by goods and services in portugal. Web value added tax (vat) is a tax levied on sales or supplies of services in portugal. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government,. Portugal Sales Tax.

From salestaxcalculator.online

Top 8 Countries with the Highest Sales Tax Rates Worldwide 2024 Portugal Sales Tax Vat is paid by consumers when paying for. € 0 for digital goods. The benchmark we use for the. The standard vat rate is 23%. Web vat rates by goods and services in portugal. Web businesses in portugal are required to collect a sales tax of 20.00% on behalf of the government, which they must submit to. Web vat rates. Portugal Sales Tax.